The data centre industry is experiencing explosive demand growth. Developers are building but can’t keep up with demand, creating a landlord-friendly market attractive to institutional investors.

The data centre industry is experiencing explosive demand growth driven by expanding use of technology and structural shifts in how data is consumed. Developers are building but they can't keep up with demand—driving vacancy rates to all-time historic lows and rents to rise. The amount of capital required to develop the capacity to fill forecasted demand is unprecedented in the industry.

Those dynamics create a landlord-friendly market attractive to institutional investors looking for opportunities to diversify their portfolios with a viable alternative asset class. For most investors, the most viable way to enter the data centre market today is via a fund investment.

Opportunity drivers

Already exponential, demand growth is accelerating

Growth in demand for data centre capacity is fuelled by surging digital data creation, cloud computing, and the widespread adoption of new technologies like artificial intelligence (AI). As AI proliferates across industries, the need for infrastructure to support these workloads is skyrocketing.

Traditional and cloud workloads continue to grow rapidly as well. Spending on cloud infrastructure is projected to reach $156.7 billion by 2027, according to IDC1—over a third of total compute and storage infrastructure spend. In fact, hyperscale companies' massive and growing cloud platforms are subsidizing their AI investments, as cloud businesses are typically very profitable.

Demand is outpacing supply

The amount of data centre capacity coming online is also rising, rapidly—but not as fast as demand. As a result, vacancy rates are at all-time historic lows and rents continue to rise.

The amount of capacity required is unprecedented

In a single 90-day period in 2023, end users in the U.S. signed data centre leases totalling a staggering 2.1 gigawatts (GW), according to research by TD Cowen.2 That's about 20 percent of the size of the entire third-party U.S. data centre market. Aggregate data centre capacity is set to more than triple by 2030, and AI could drive demand up much more than that. (Dell CEO Michael Dell predicts that AI will drive a 100x increase in data centre demand over the next 10 years.3)

Developing this massive amount of data centre capacity will require a huge amount of capital—a single facility can cost upwards of a billion dollars (dependent, of course, on its size, but facilities continue to grow in scale).

Why data centres are increasingly attractive to institutional investors

Demand/supply dynamics create a landlord-friendly market attractive to institutional investors looking for opportunities to diversify their portfolios with a viable alternative asset class. In fact, 97% of respondents to CBRE's 2024 Global Data Center Investor Sentiment Survey,4 many of whom are the world's largest institutional real estate investors, reported plans to increase their capital deployment in the data centre sector while 3% of respondents are looking to maintain their current allocation.

Advantages of the data centre sector include portfolio diversification, long-term stable cash flows from high-quality tenants, and scalability.

Portfolio diversification

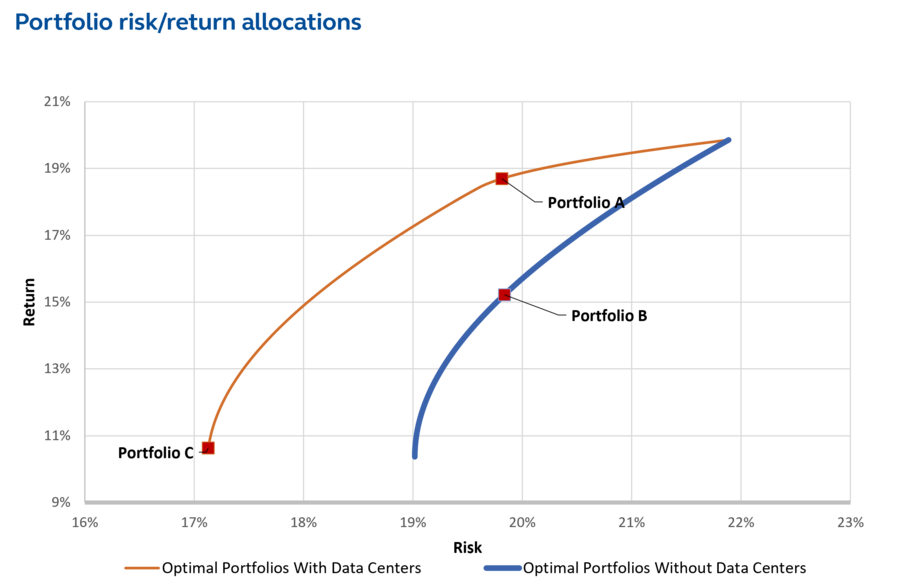

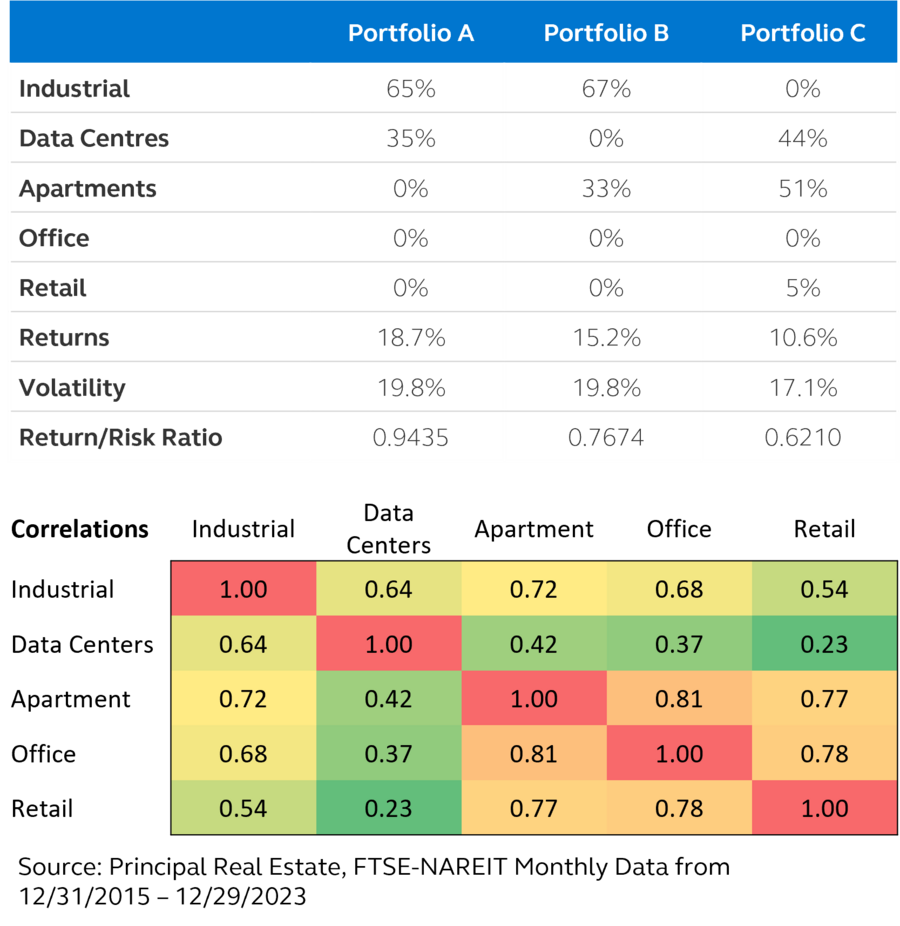

As part of a broader real estate portfolio, data centres are a smart diversification strategy due to low correlations to other assets and a favourable risk/return profile. A diversified real estate portfolio with industrial and data centre assets yields (in the example shown) a much larger return for the same level of risk as a portfolio with industrial and apartment assets.

Optimal portfolios with data centres generate higher returns for the same level of risk (sample listed REITs portfolio)

Long-term stable cash flows from high-quality tenants

While a relatively small number of tenants consume the vast majority of data centre capacity, these are the world's largest technology companies with excellent credit profiles—Google, Amazon, Microsoft, and Meta, in addition to a few others. Investors can reduce concentration risk with a larger fund vehicle that provides exposure to multiple assets in multiple markets.

Longer leases, many times in excess of 10 years, give investors exposure to cash flows from high-quality credit tenants at higher yields than most other property types.

Scalability

As investors look to diversify their portfolios to include more alternative investments, data centres can help to quickly achieve allocation goals. The individual deal sizes for other attractive alternatives —self-storage, manufactured housing, and single-family residential, for example—are quite small. Data centres are one of the few alternatives that can be done at scale without having to assemble large portfolios of assets. Given the outsize magnitude of data centres relative to other alternative investments, they represent a major shift in the investment portfolio.

A new approach: Data centre fund investment

Because of the advantages, data centres are a growing component in some open-end diversified core equity funds and are becoming a larger share of the net lease sector. Where investors historically might have bought a large office building leased to a corporate tenant based on the fact that it had a long-term net lease in place, that's not a particularly attractive opportunity in today's market. Data centres represent an opportunity for those types of investors to get similar cash flow profiles (long-term stable income) with a high-quality credit tenant while growing exposure to an alternative asset class.

For most investors, a fund investment is likely the most viable way to enter the data centre market today, given that a single facility can cost upwards of a billion dollars.

In addition to higher-than-ever and still-rising aggregate demand, individual data centres are becoming ever larger, and thus require much more capital to develop. Those dynamics have changed the optimal investment approach.

Collaboration is key

Given the highly specialized nature of the data centre industry, experience and access are critical to successful execution. Data centre investing requires a high degree of specialization to source, build, and lease the properties. If you're looking to invest in a data centre fund, look for an investment firm partner with:

- Data centre sector-specific experience

- A track record of high-quality investments sourced and closed

- A network of developers with technical and location-specific expertise

- Ability to attract strong tenants

As an active commercial real estate investor for more than 60 years— including more than 18 years in the data centre sector—Principal Real Estate has witnessed the asset class evolve and adapt to the changing needs of occupiers. Our experience has resulted in a historically favourable track record and meaningful industry relationships.

1 IDC, October 2023

2 TD Cowen, July 2023

3 AI Business, March 2024

4 CBRE Global Data Center Investor Sentiment Survey, June 2024

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return.

Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.