Dan Mikulskis

Law and Regulation

Statement from key EEA regulators sets clear expectations for resilience of LDI portfolios

Investment

Charlotte Moore says the path forward will vary depending on scheme circumstances

Investment

PP speaks to trustees and consultants about the liquidity squeeze and what could happen next

Defined Contribution

New research paper highlights the benefits and drawbacks of consolidation

Investment

Charlotte Moore looks at how trustees are now viewing sectors such as energy and defence

Defined Contribution

Ignoring the ‘pensions Cinderella’ will return to haunt us, says Stephanie Hawthorne

Defined Contribution

ILC finds third of Gen X face retirement hardship; LCP says younger members may need to up risk

Defined Benefit

Move come as consolidator prepares to conduct first transactions

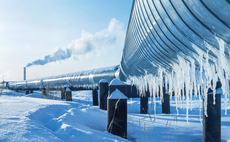

Investment

Up to £350bn of investible assets could be found within the energy sector over the next 30 years as investment in opportunities to decarbonise the economy by 2050 increases, Lane Clark & Peacock (LCP) finds.

Defined Benefit

The 4% rule of thumb often used to define a sustainable approach for drawdown in retirement is no longer fit for purpose due to prevailing and sustained market conditions, says Lane Clark & Peacock (LCP).