Colin Cartwright, Partner, Aon

Despite it being another year of significant volatility in the investment markets, 2023 is set to be a record year for bulk annuities. This is a huge testament to how pension schemes and advisers have prepared to take advantage of transaction opportunities to secure member benefits.

Coming into 2023, the interest rate payable on UK Government bonds, (gilt yields), was significantly higher than levels we have seen for many years. This has continued throughout 2023 and is expected to be the case for the foreseeable future. This has largely resulted in the improvement to pension scheme solvency funding positions, putting many schemes in a position where their buyout target is a lot closer than was previously expected and creating two common scenarios:

▪ Schemes fully funded on a solvency basis with good liquidity and a flexible low risk investment strategy have found themselves in a very strong position to transact with an insurer in 2023.

▪ Schemes well-funded on a solvency basis but with illiquid assets which require innovative solutions so they too can transact.

Therefore, it has been vital for advisers to consider carefully the pre- and post-buy-in risks:

- For partial buy-ins, this means considering residual assets post-transaction and additional liquidity constraints.

- For full buy-ins, this is largely whether sufficient assets can be realised in order to pay the premium.

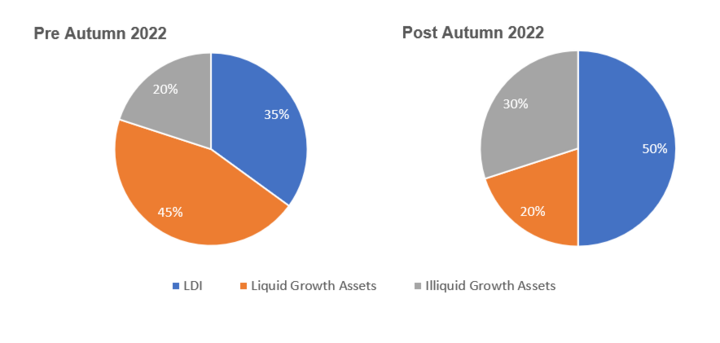

One of the biggest challenges for schemes of all sizes in this new environment, has been an unintended higher allocation to illiquid assets. This ‘illiquids problem' has become a more prominent issue where scheme asset sizes have shrunk, and hence illiquid assets have become a larger proportion of the overall allocation. A typical portfolio before and since last year is illustrated below.

Insurers are aware of the impact this is having on otherwise 'transaction ready' schemes, and there have been innovative solutions coming to market throughout the year. In recent deals we have seen a combination of approaches used by schemes and insurers:

▪ Deferred premiums are often available to cover the run-off (or orderly disposal of) illiquid assets over a specified period.

▪ Insurers have been increasingly receptive to taking on, or locking pricing to, illiquid assets held by large schemes as further shown in our 2023 UK Insurer Survey.

▪ Other innovative solutions have been emerging including loans from financial institutions secured against illiquid assets as an alternative to deferred premiums.

▪ Sponsors have also had a role to play - for example, loans have been structured from sponsors to schemes to allow run-off or orderly sale of assets, or instead assets have also been sold to the sponsor.

▪ And finally, schemes have used specialist brokers to find best pricing for assets, where they needed to be sold on the secondary market.

There are options for schemes looking to achieve a managed exit from illiquid assets, the key is to consider this early and explore the market to find the best solution.

The considerations by scheme size

Larger deals (£1 billion+)

There are more large schemes and complex transactions in the market than ever before, including the UK's largest bulk annuity transaction, RSA's £6.5 billion buy-in with PIC. Innovative asset solutions were a vital part of this transaction, with a large illiquid portfolio to negotiate. Key learnings have been taken from this and all different types of deals throughout the year, both by Aon as adviser on RSA, and the wider market.

Indeed, our investment expertise was also a major factor in the recently announced largest ever single scheme transaction - Boots Pension Scheme's £4.8 billion buy-in with Legal & General. A key element in achieving this transaction, was dealing with the significant portfolio of illiquid investments held by the scheme. Working in close partnership with the sponsor and trustees, we applied our experience, innovative solutions and lessons learned from other deals of similar size such as RSA and Telent, ensuring this was not a barrier to securing benefits of all 53,000 retirees and deferred members of the scheme.

The middle ground (£150 million - £1 billion)

The majority of transactions, by deal volume, take place in the mid-market space. The recent trend is that insurers have been increasingly selective when pricing new business and are focusing on cases where they perceive a competitive advantage.

Ensuring schemes do their asset preparation early - so they hold low risk, liquid assets and have a clear picture of the timeframes for adjusting and selling assets - has meant they can negotiate with the insurer on pricing and the terms and approach for rolling forward the pricing early in the market engagement process.

Smaller Schemes (sub-£150M)

Many insurers now require exclusivity to engage with any transactions under £100 million. It has therefore, been vitally important to be clear from the outset regarding the structure of a transaction, and how the scheme's assets are aligned for it, as well as considering the requests of insurers around the price-lock (the way the premium moves as a result of changes in market levels and conditions).

Agreeing these structuring and asset related items early in the process leads to less risk and cost for schemes and ultimately greater transaction certainty.

Looking ahead to 2024

The key for all schemes going forward is asset preparation. Early consideration should be given to all possible barriers and the options to overcome them. The best prepared schemes will always stand out in a very busy bulk annuity market, giving trustees more certainty for insurer interest and a smooth transaction. If you would like more information about how your scheme's assets can be well-prepared for a possible buy-in transaction in 2024 and beyond, please contact our Risk Settlement Investment specialists: [email protected].