As an active investment manager with a clear focus on sustainability, Van Lanschot Kempen created the Kempen SDG Farmland fund to offer investors the opportunity of an innovative investment solution with clear impact goals.

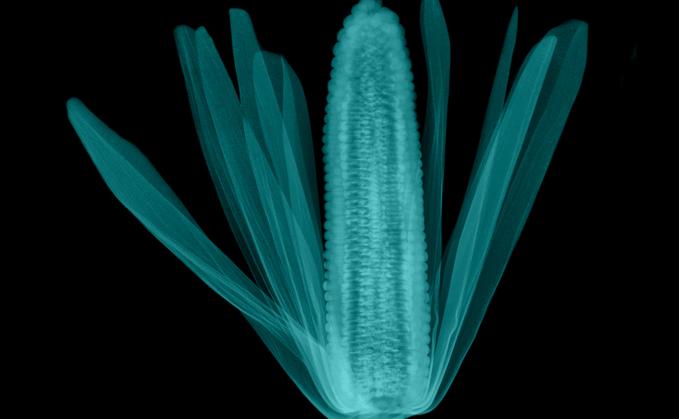

Our sustainable, actively managed fund invests in farmland globally, helping farmers shift from conventional to regenerative farming and enabling them to maximise the value of their land and their crops over the longer term. This progressive and scalable way of investing creates a positive impact on the environment and associated rural communities.

The object is to provide sustainable long-term returns for investors. Putting this in context, the Fund's net average annual return target over a 10-year time horizon is 6-8%.*

Financial and sustainable gains come from tapping into various sources of returns: income from rent, increasing crop yields and land value, and carbon capture fees or biodiversity improvement.

Managed in this way, sustainable farming can be a good store of value being a real asset: with productive soils growing scarcer and downside risk carefully managed. Furthermore, farmland can significantly boost portfolio diversification as it has quite different return drivers to traditional asset classes.

This fund invests primarily in developed markets and across different crop types. We particularly look for countries where we see a competitive advantage in a specific crop. We have a diversified approach to ownership, some farms being fully owned by us, others part-owned with sustainable local partners.

Focusing on medium-sized farms between EUR 10-25 million, we aim to grow alongside them through providing the capital and knowhow needed to add value to the land and build long-term sustainable businesses.

Our team of sustainable investing specialists identify and maintain close oversight of the farms we invest in and agricultural expertise is deeply ingrained in the team. We believe our approach to regenerative farming offers the potential for attractive returns over the long term along with measurable positive impacts for society.

*The scenario is an estimate of future performance based on information from the past and does not provide an exact indication. Your returns will depend on how the market performs and how long you retain the investment or product. Future performance is subject to taxation and fees which will depend on each investor's personal situation and which may change in the future

General risks to take into account when investing in Farmland

Please note that all investments are subject to market fluctuations. Investing in agricultural land has an average risk. These categories are generally characterised by stable income and relatively stable collateral. On the other hand, the tradability can be limited.

Disclaimer

This is a marketing message for professional investors.

Van Lanschot Kempen Investment Management NV is authorised as a management company and regulated by the Dutch Authority for the Financial Markets (AFM). The Fund is registered under the license of Van Lanschot Kempen Investment Management NV at the Dutch Authority for the Financial Markets (AFM). The Fund is notified for offering in a limited number of countries. The countries where

the Fund is notified can be found on the website. The Fund is only available for professional investors.

The information in this document provides insufficient information for an investment decision.

Please read the the prospectus (available in English) and the sustainability-related disclosures before making an investment decision. These documents of the Fund are available on the website of VLK (vanlanschotkempen.com/en-nl/investment-management/fund-library) The information on the website is (partly) available in Dutch and English. Here you can also find our sustainability-related disclosures.

Capital at risk

The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance provides no guarantee for the future.