Separating wheat from the chaff

Natural capital is crucial for both economic activity - and for life on earth. While it is estimated that over $40 trillion of economic value (more than 50% of global GDP)[1] depends on nature or its services, natural capital is also vital in the fight against climate change. Many segments of natural capital - like forestry and regenerative agriculture - can absorb carbon from the atmosphere and enhance biodiversity. But only if done in the right way.

However, not all sources of investable natural capital are sustainable and deciding whether a natural capital source is renewable or non-renewable is not always straightforward.

The cost of doing nothing

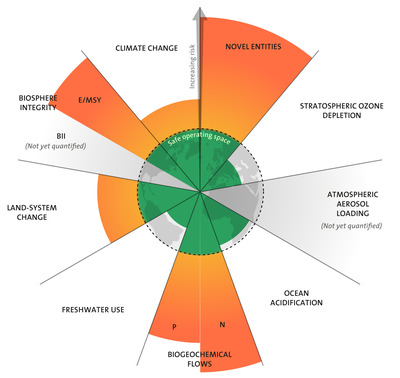

Increasing human economic activity has put the planet under tremendous pressure and scientists from the Stockholm Resilience Centre[2] introduced a framework that shows how much pressure the ecosystems can withstand. Their research shows that the impact of human activity is already extending beyond the safe operating space of five planetary boundaries.

Investing - not philanthropy

Institutional investment in natural capital is still very limited. Currently, investments come mainly from investors that believe short-term investments in more regenerative systems will create better long-term outcomes and from pure impact investors prepared to accept lower financial return for better societal outcomes.

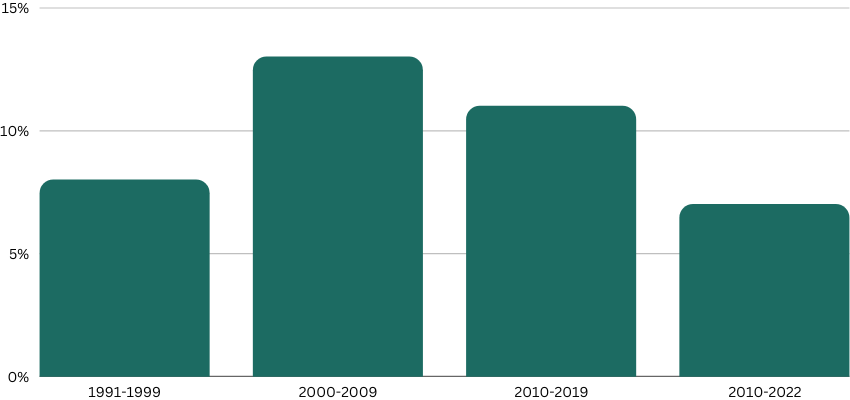

However, restoring natural capital does not have to be just philanthropy. Existing investors in established real assets such as farmland and timberland, for example, have long reaped the financial benefits of these investments, as evidenced by the strong performance of the NCREIF Farmland and NCREIF Timberland indices which track institutional investments in the US markets.

Graph 1: NCREIF Farmland Index Quarterly returns

Source Van Lanschot Kempen, September 2023

General risks to take into account when investing in Farmland

Please note that all investments are subject to market fluctuations. Investing in agricultural land has an average risk. These categories are generally characterised by stable income and relatively stable collateral. On the other hand, the tradability can be limited.

Disclaimer

This is a marketing message for professional investors.

Van Lanschot Kempen Investment Management ( VLK IM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.

Capital at risk

The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance provides no guarantee for the future.

[1] World Economic Forum ‚‘Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, January 2020

[2] Stockholm Resilience Centre - stockholmresilience.org/research/planetary-boundaries.html