John Southall, Head of Solutions Research, LGIM

DB pensions: Approaching an inflection point

With dramatically improved funding levels, thanks in large part to the significant rise in gilt yields over the past 18 months alongside a partial recovery in risk-asset prices, the DB market is approaching an inflection point. The demand from schemes that are already - or soon will be - in surplus on a buyout basis is a multiple of the annual capacity of the pension risk transfer (PRT) market.

While many pension schemes therefore are, or soon could be, fully funded on a buyout basis, they may not be able to transact immediately. As a result, we're likely to see schemes adopting a holding pattern as they prepare for a potential buyout. The fundamental question is therefore: How should schemes invest as they approach their buyout endgame?

Buyout aware?

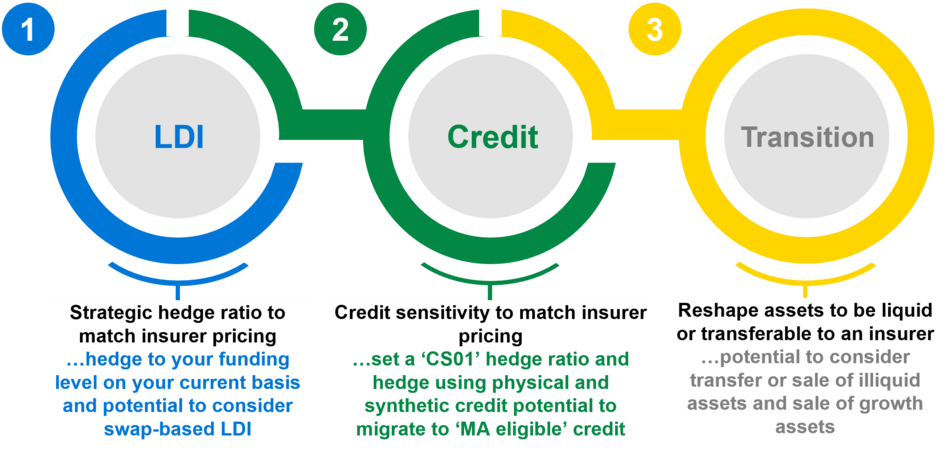

The natural response to this situation may be a ‘buyout-aware' (BOA) strategy, which can be defined as a hedging strategy that seeks to minimise short-term volatility relative to insurer pricing. This involves a mix of public investment-grade credit and liability-driven investment (LDI), with the ideal mix potentially varying with the duration of the scheme. Under a BOA approach the key components are hedging rates and inflation risks, seeking to hedge credit sensitivity of the liabilities and reshaping assets to be liquid and transferable to an insurer:

Buyout aware: Invest ‘like an insurer

Investment themes for illustration purposes only, actual buyout investment strategy will be bespoke for each scheme. Past performance is not a guide to the future. The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested

We believe that such a hedging strategy could be a good starting point for schemes in their holding pattern. However, in general the aim of schemes is not ‘funding level volatility minimisation' but paying pensions. As a result, a pure BOA approach isn't always the best one.

In contrast to BOA, a ‘buyout-ready' strategy could be defined as one designed to optimise overall outcomes, as opposed to simply minimising short-term funding level risk. Finding an ideal buyout-ready strategy is no easy matter. As we shall see, the answer depends on a scheme's circumstances, beliefs, and constraints.

No buyout-aware strategy eliminates risk

Achieving zero risk before buyout is impossible. Reasons for this include longevity uncertainty, unhedgeable moves in buyout pricing and the credit risk on corporate bonds (they can default but liabilities won't). Another complication is that many schemes don't know their buyout position. The scheme actuary can make a rough estimate, or the trustees can request indicative quotes from insurers, but obtaining accurate pricing is a significant exercise and can be challenging unless the insurer is confident the transaction will progress.

Outcome-focused

We believe it's important to focus on ‘ultimate outcomes'. Here this involves studying the range of potential buyout funding levels at the projected point at which the trustee believes buyout can finally happen.

Our quantitative approach seeks to optimise the investment strategy of schemes in a holding pattern. This involves modelling thousands of potential economic and demographic scenarios and choosing the investment strategy that seeks to offer the most potentially attractive outcome distribution. A high-level overview of this approach is shown below:

For illustrative purposes only. Past performance is not a guide to the future. The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested

A key feature of this framework is that we don't assign greater worth (or ‘utility' in economics speak) to a scheme being overfunded. This reflects a view that the priority should be the security of promised benefits and the scheme shouldn't run unnecessary risk.

This model embeds a number of assumptions including those concerning capital markets, longevity risk, the credit sensitivity of liabilities,' and uncertainty in the current buyout position.

Projecting outcomes

The model projects pension scheme outcomes, capturing the aspects discussed above. It is a ‘completion strategy' in the sense that it optimises a portfolio around any illiquid assets currently held. For this we use three key building blocks:

- A multi-asset diversified growth strategy. This includes an allocation to investment grade public credit but only for diversification purposes

- Investment grade public credit. This allows schemes to ‘bias' towards credit. This can make sense for schemes in the endgame

- LDI to hedge rates and inflation risks

Illustrative results

For illustration, we consider four example schemes with durations of 12 or 20 years and estimated initial funding levels of 95% or 110%. We've assumed an anticipated time horizon to buyout of five years and that 10% of assets are illiquid.

Optimised completion strategies

Source: LGIM calculations at 30 June 2023

For illustrative purposes only. Past performance is not a guide to the future. The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested

Key features of the optimal strategies are:

- Credit: Relatively high investment grade public credit allocations - for comparison the purple book indicates that a typical scheme holds only 22% of assets in corporate bonds. This reflects a desire to hedge the credit sensitivity in buyout liabilities. Even conservative estimates of the sensitivity result in more than 22% of assets in credit by market value

- LDI: Full hedging of interest rate and inflation risk

- Diversified growth: Maintaining some exposure to diversified growth even when estimated to be overfunded, owing to residual risks, including uncertainty as to the current funding level.

There is, unsurprisingly, considerable overlap with BOA strategies. Key differences are a completion around illiquid assets, an allocation to other diversifying return drivers and a move away from short-term risk minimisation.

Strategies vary with circumstances and beliefs

We stress that the ideal strategy varies with both scheme circumstances and beliefs. For example:

- Higher funding levels tend to lead to holding less in growth assets as there is less upside opportunity relative to downside risks at higher funding levels

- Larger uncorrelated risks tend to lead to more in growth assets. For example, longevity risk can cause an overfunded scheme to become underfunded. In the absence of a longevity hedge it can make sense to target a higher return. Uncertainty as to the ‘true' current funding level is another source of uncorrelated risk

- The more illiquid assets there are, the less there tends to be growth and credit as a completion strategy. This is because the illiquid assets have some of these risk exposures

We've assumed for illustration that the priority is securing existing benefits, so attached no additional utility to surpluses on buyout. However, there are growing noises that this needn't be the only approach. For example, the money could be used to enhance existing benefits or help fund defined contribution (DC) schemes of the same employer who are generally on track for worse outcomes. This tends to lead to more aggressive strategies. Acting in the other direction, behavioural factors such as loss aversion and regret risk, could lead to trustees opting for a more cautious approach, as could a weaker sponsor covenant.

Conclusion

Buyout-ready strategies are scheme and belief-specific. At a high level our analysis suggests that they should normally have high interest rate and inflation hedge ratios and a sizeable allocation to investment-grade public credit. However, there are other interesting nuances, such as the influence of uncorrelated risks and uncertainty in the buyout position that can mean an allocation to other growth assets makes sense. There is also often a need to complete around illiquid assets.

All models must be taken with a pinch of salt, of course, but we believe our quantitative framework can act as a useful starting point for schemes approaching their buyout endgames.

To find out more please contact Lisa Purdy, Head of Pooled Solutions Distribution at LGIM [email protected]

Key Risk Warnings

Past performance is not a guide to future performance. For professional investors only. The value of investments and the income from them can go down as well as up and you may not get back the amount invested. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor's circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.

This post is funded by Legal & General Investment Management Ltd