The current environment of high inflation and rising interest rates is set to have a profound effect on the pricing of real estate and real estate debt.

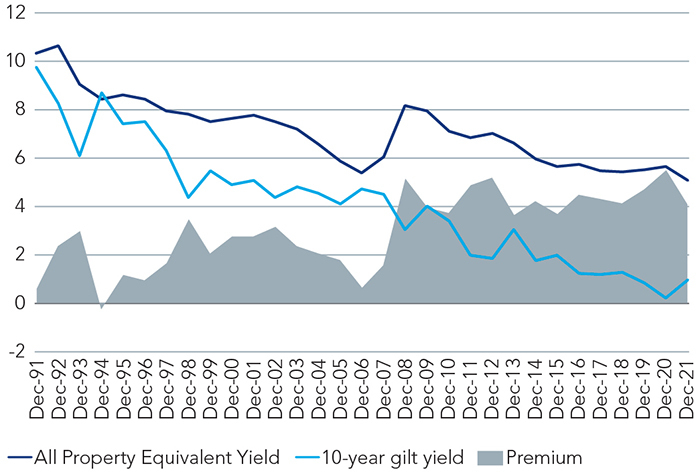

Investors traditionally value real estate in comparison with the risk-free rate: with a premium applied to allow for the risk associated with holding real assets, the illiquidity of these assets and the depreciation of physical buildings. Although real estate loans are typically agreed for periods of three to five years, it is the 10-year government bond yield that is used as the risk-free rate benchmark in fair value analysis, because it has a similar maturity profile to prevailing lease lengths of prime property cycle (around the last 15 years).

During the 2008-09 global financial crisis (GFC) property values fell across the world. Moreover, real estate looked attractively priced in the aftermath of the GFC as monetary policy put significant downward pressure on bond yields. As ongoing monetary tightening pushed bond yields lower than ever before - despite significant property yield tightening in the years following the crisis - real estate has remained a relatively attractive proposition for an entire property cycle (around the last 15 years).

The figure below shows that the average premium for holding real estate rose from approximately 190 bps to 440bps in the post GFC years. However, on an absolute basis, returns have been low, which has made cheap leverage an attractive option for many investors.

Today we find ourselves in a rapidly changing rate environment. In a bid to fight inflation, central banks are aggressively pushing up rates, and governments are trying to find ways to stimulate growth. We have seen inverted yield curves. So, if low rates reduced absolute returns for real estate lenders, what can we expect now that rates are rising?

Relative value in real estate debt

We certainly believe that the relative value of real estate debt looks attractive in the current environment. Rising rates puts upward pressure on real estate yields. As can be seen in the figure above, the real estate market may lag a little (as it did in 2007) but in the end, investors will require a premium for holding real estate assets compared to government bonds. In times of low growth (and certainly in a recessionary environment), rental growth will be harder to achieve, and therefore upward yield pressure should result in capital value decline for real estate owners. The possibility of (modest) capital value decline is a compelling argument for allocations to real estate debt.

For allocators of capital, this changing investment environment should move real estate debt from not worthy to noteworthy. By making an allocation to real estate debt as part of a wider real estate strategy investors can reduce the impact of real estate yield widening on their overall portfolio return, while at the same time still maintaining exposure to the income that real estate assets generate.

At average leverage levels of 60%, the underlying real estate assets can lose 40% of value during the life of the loan before the lender suffers a capital loss. Provided the property income is maintained at levels that allow borrowers to pay interest, real estate debt strategies continue to deliver stable income without much (if any) correlation to the real estate market that serves as its collateral. As part of a wider real estate portfolio, an allocation to real estate debt can help stabilise overall portfolio returns during a downturn.

This article is an excerpt from our latest View from Public Markets publication on 'Reappraising the value of real estate debt'. Click here to read more of our views from across the investment floor

This post is funded by Federated Hermes

Disclaimer:

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested. Any investments overseas may be affected by currency exchange rates. Past performance is not a reliable indicator of future results and targets are not guaranteed.

The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.