Energy markets and the related ‘cost of living' crisis is undoubtedly causing hardship in the UK and elsewhere but in two respects, infrastructure assets are the beneficiaries:

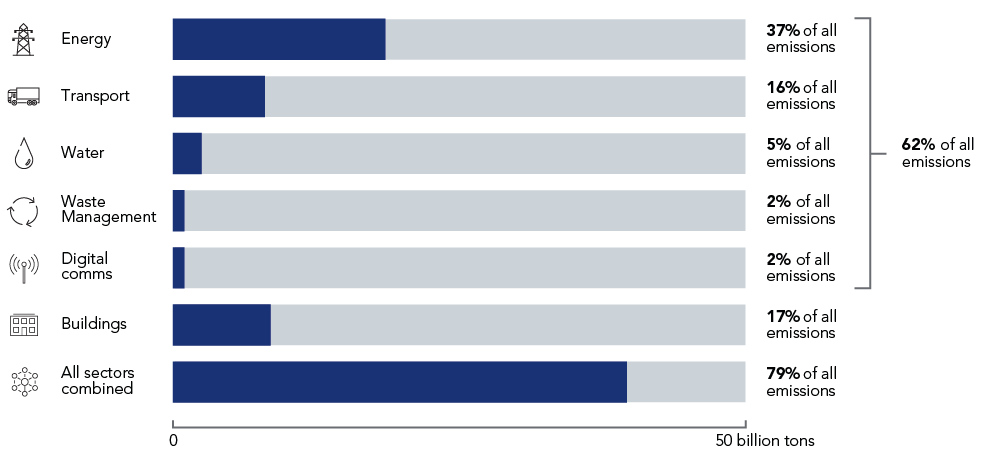

Infrastructure is central to the transition to net zero. The infrastructure sector - through energy, transport, water, waste management and digital communications - accounts for 62% of global greenhouse gas emissions, according to the United Nations Office for Project Services.

There isn't going to be an energy transition if we cannot achieve decarbonisation via infrastructure and this realisation is driving a lot of investment opportunities at the present time. It's one of the reasons why the infrastructure sector is quite hot at the moment and is likely to remain so.

Another factor is inflation. The majority of our assets have a contractual or regulated linkage to inflation - the revenues are uplifted by the consumer price index (CPI) or the retail price index (RPI). I'm not going to express a view on where inflation will go over the medium- to long-term. But if you anticipate higher-for-longer inflation, it adds to the attraction of infrastructure as an asset class.

Infrastructure is central to the transition to net zero

The infrastructure team at Federated Hermes manages about £3bn of capital across co-mingled funds, segregated and managed accounts.

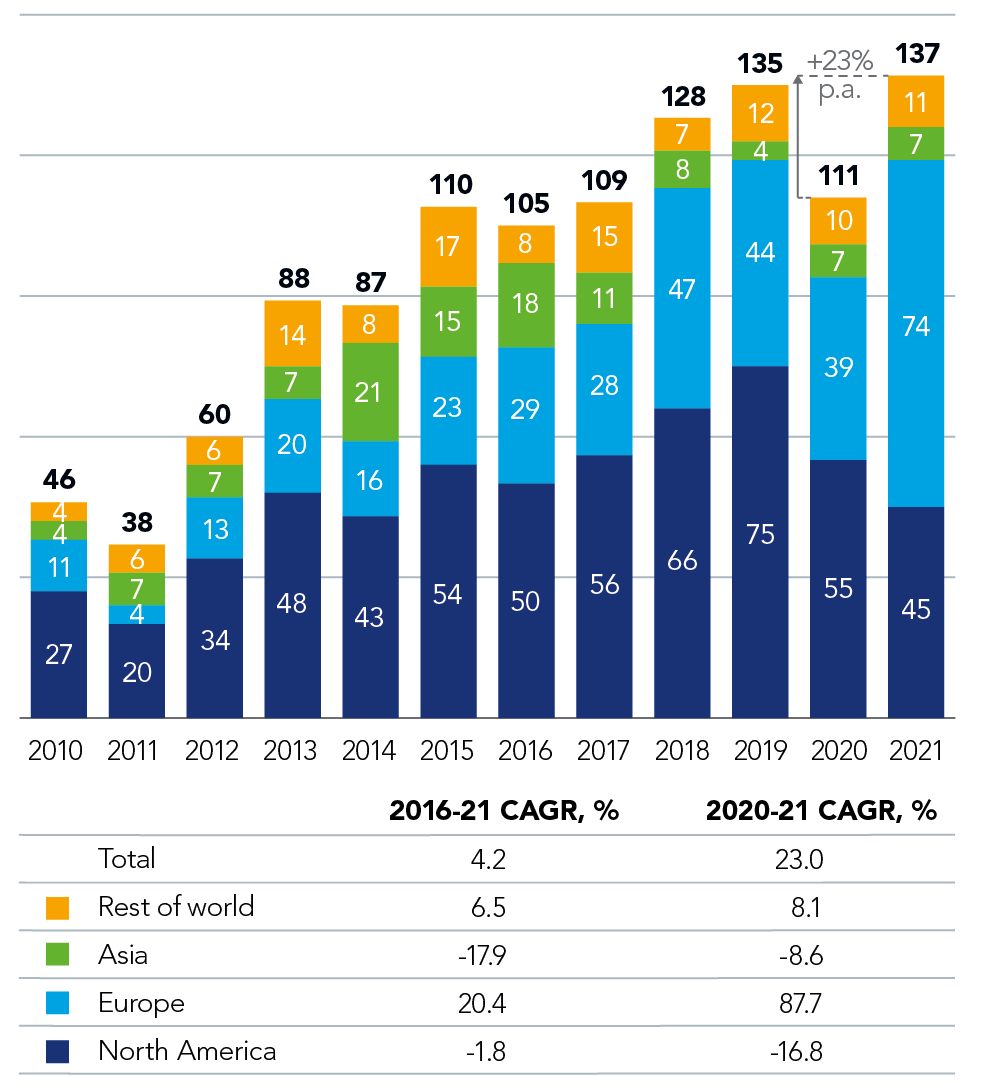

Infrastructure funds hit an all-time high in 2021

This article is an excerpt from our latest Spectrum publication on "Have alternatives gone mainstream?" Click here to read more of our views from across the investment floor.

Disclaimer:

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested. Any investments overseas may be affected by currency exchange rates. Past performance is not a reliable indicator of future results and targets are not guaranteed.

The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

This post is funded by Federated Hermes Limited