Mixing younger savers with environmental, social and governance (ESG) issues conjures images of protest, divestment and social action. The reality is more complicated. We explore what happens when ESG imperatives and well-known brands come into conflict.

In LGIM's latest research[1] among 4,500 defined contribution workplace pension-scheme members across the UK and Ireland, we sought to find out what savers of different generations thought on diverse issues affecting ESG investing - from the climate to COVID-19. As in the previous two years, our results revealed a sharp divide.

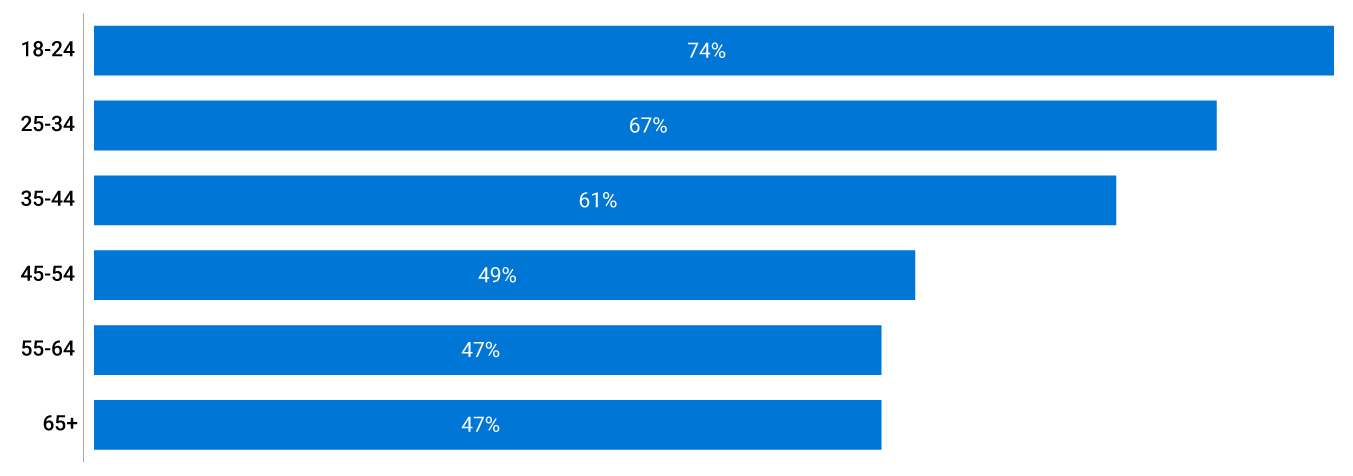

For example, when asked if, in the long run, they think pension funds which have a net-zero carbon emissions target by 2050 will perform better than those that do not, three-quarters of Generation Z (born between 1997 and 2012) agreed. Conversely, less than half (48%) of Baby Boomers (born between 1946 and 1964) said yes.

Younger savers are also prepared to translate their beliefs into their investments, with one 25-year old saver saying she would "disconnect" with her pension provider, if she found out that it was not changing environmental, social and governance practices on behalf of its members.

I believe pension funds which have a net-zero target will perform better than those that do not

Source: LGIM, UK accumulation and decumulation data sorted by generation/age of respondents, January - February 2022.

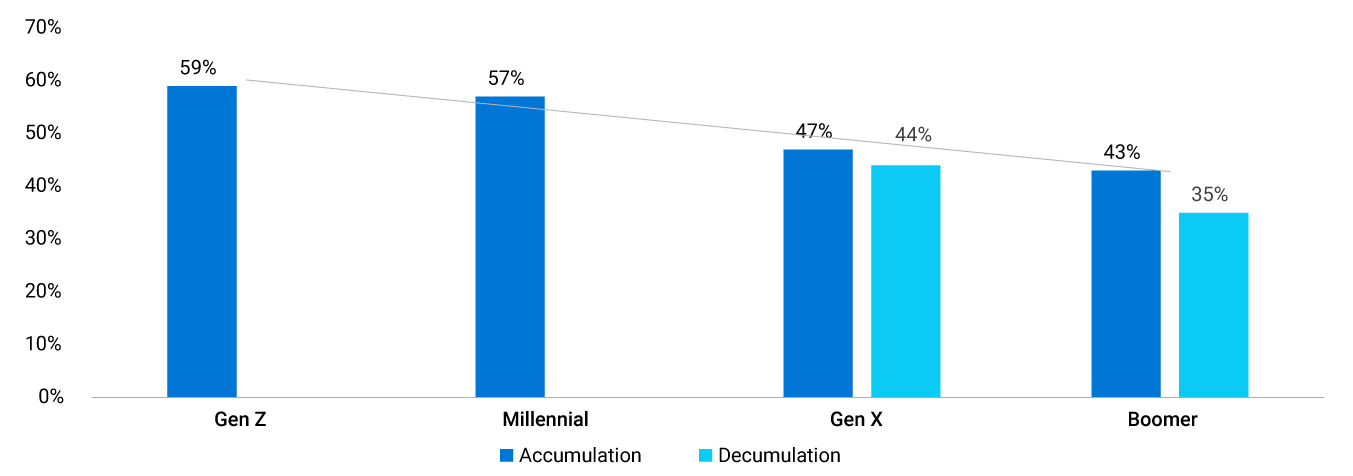

So what is pulling the generations apart? It appears that news about ESG issues has an outsized impact on younger generations (Z and Millennials: born between 1981 and 1996). Nearly 60% of Gen Z (59%) and Millennials (57%) in accumulation say they are more likely to want to divest, rather than engage, because of the things they have seen in the media, compared with just over four in 10 Boomers (43%). Similarly, over half of Gen Z (52%) and Millennials (54%) agreed that pressure groups are taking a stronger stance on divestment versus engagement and that this was influencing how they felt as well, as compared with 45% of Generation X (born between 1965 and 1980) and 43% of Baby Boomers.

The way the media presents these issues makes me want to divest from companies with poor practices, rather than engage

Source: LGIM, UK accumulation and decumulation data sorted by generation/age of respondents, January - February 2022.

No use Boohoo-ing over spilt milk

But this is not the whole picture. When it comes to sinful brands with a strong name recognition amongst their peers, younger generations are happier to stay invested. For example, the percentage of 18 to 24-year-olds keen to take an engagement rather than divestment approach with *Boohoo, having explored their supply-chain and working-practice issues in a case study, is over double that of those in the 64+ age category (31% vs. 14%).

This may not be so surprising, when we consider that younger investors respond to big names. Whether it's the familiar FAANG (Facebook, Apple, Amazon, Netflix, Google/Alphabet)* tech stocks that reflect the online world they have grown up in and are touted by internet trading platforms, or the meme stock craze, younger investors are drawn to the brands they know and trust. Even in their daily consumption habits, where they favour familiar brands.

And with all the attention focused on environmental and social responsibility, some savers are experiencing fatigue, believing that brands are cynically constructing an ESG ethos, in order to burnish their corporate credentials. One female millennial responded "go woke, go broke… I don't trust companies that put their image above their success when it comes to investments", when we asked how respondents would feel if they knew their pension was invested in companies with a perceived negative social impact.

Under the influence

So, it's not as straightforward as saying that younger investors are more ‘switched on' to ESG, but perhaps more a case that they are more easily influenced: absorbing social media and the news environment around them. The flipside of this is the opportunity to make a positive association between pensions and social change, and to administer a wake-up call to those in accumulation. 60% in accumulation had not made the link between issues they see in the media and their pensions before, especially younger generations. Yet nearly two-thirds (64%) felt more positive about LGIM and the companies involved having read the case studies, which was more concentrated amongst younger generations, with one female saver commenting that she was "glad LGIM is flexing its muscles"!

Most promisingly, the percentage of Gen Zers feeling better about LGIM after reading the case studies has more than tripled from 25% last year to 77% this year. Sometimes, it's as simple as letting members know what is going on. As one female Zer in accumulation noted: "I feel like it's good because I'm contributing without realising or trying, and it's something we should all do."

For more insights into how inflation, COVID and COP-26 have affected DC savers' ESG commitments, go to DC ESG research | Defined contribution | LGIM.

Important Information: For professional clients only. Past performance is no guarantee of future results. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Views expressed are of LGIM as at 22.04.2022. The Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and *(b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272.

[1] LGIM research: Quantitative research of 4,500 defined contribution workplace pension savers across UK and Ireland, survey taken between January and February 2022.

This article is sponsored by Legal and General Investment Management.