Hatty Goodwin, Senior Consultant Aon

In Aesop’s fable ‘The Ant and the Grasshopper’ a grasshopper sits back relaxing in the sunshine and mocks an ant for working hard over summer to stash enough food to survive the winter.

This classic cautionary tale teaches us the benefits of taking a long-term view and of doing the hard work up-front, so you have an easier journey and can emerge into the spring sunshine unscathed.

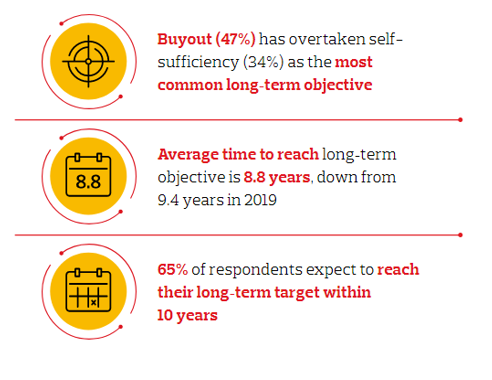

Aon's 2021/22 Global Pension Risk Survey shows more schemes are targeting buyout and nearly two-thirds expect to get there within 10 years. So how can your investments help your buyout journey and make you stand out in an extremely busy market?

"Why bother about winter?" said the Grasshopper. "We have got plenty of food at present."

While the grasshopper basked in the sun, the ant knew success relied on preparation - even if it meant missing out on some fun.

If you are running a pension scheme, it does not matter if you are 15 or five years away from buyout - you can be more ant!

By focusing on your scheme's buyout objective and by preparing your assets you can:

- Reduce investment risk along your journey

- Minimise cost and execution risk at the point of transaction

- Maximise insurer engagement, by reducing the risk that mis-matched assets make a viable transaction unaffordable.

While the sun is shining

For schemes 10 or more years away from buyout, the focus remains on closing the funding gap and using the tools available to make the journey shorter and smoother.

One of the tools to use could be partial (usually pensioner) buy-ins. When you enter an insurance contract to secure the future cash flows (such as pension payments) associated with some of your liabilities, not only does this hedge longevity risk, often the largest unhedged risk remaining, it also provides more precise cash flow and inflation matching than traditional assets.

Experience over the past couple of years shows insurers favour ‘repeat buyers', schemes which demonstrate they can complete a transaction. In a competitive market, making a scheme attractive to insurers by holding the best assets is vital; by doing this we have seen schemes secure full buyout many years earlier than they originally expected.

As summer starts to fade

For the many schemes who are within 10 years of buyout, the focus shifts to managing risk. You need to hold assets that insurers like, so they stay on track to be able to meet the cost of the transaction. You need to:

- Reduce growth assets as they approach full funding and no longer need a high investment return

- Assess liquidity, identify any illiquid holdings that could delay or increase the cost of a transaction, giving time to maximise value in any sales

- Hedge interest rate and inflation risks on buyout liabilities

- Invest in credit to make sure assets match movements in insurer pricing. Consider hedging credit exposure in the same way interest rate and inflation risks are hedged.

As winter turns to spring

When you are within two years of buyout it is all about getting ready to transact. Your focus is on ensuring your assets are both liquid and flexible so that they can be transferred to an insurer quickly and cheaply when you come to transact.

Ensure your asset allocation can be adapted to match precisely the chosen insurer's pricing basis once you decide who you will transact with. Using synthetic rather than physical credit to hedge credit exposure is both cheaper (7x cheaper to transact) and lower risk (holds value better during market sell-offs). As a result, having exposure to synthetic credit provides a cheap and flexible way to match insurer pricing more effectively.

When choosing an insurer, you also need to be specific about your Environmental, Social and Governance (ESG) criteria. As an increasing area of focus both for schemes and insurers, integrating ESG considerations into the selection of your provider, and the associated due diligence, is vital.

"The grasshopper had learned to think ahead and plan for the future."

No matter where you are on your journey you should agree your target and align your investment strategy:

- Invest with buyout in mind

- Focus on your buyout liabilities when managing risk in your investments

- Maximise your appeal to insurers and save money when you transact

- Use the right tools

- Holding the right assets can be the difference between success or failure of a transaction

- Integrate ESG

- Make sure the provider you select meets or improves your standards when it comes to ESG integration.

This post was funded by Aon