The world faces a much bigger challenge than Covid-19, which is why the impact of climate change has been factored into the forecasts of Expected Returns for the first time.

They say history doesn't repeat itself, but it does rhyme, and the parallels with 100 years ago make for interesting comparisons. The end of the Spanish flu pandemic of the 20th century ushered in the economic growth of the Roaring Twenties. In the 21st century, the end of Covid-19 is also set to bring much-needed economic recovery… but this time it's different.

Pandemics come and go, but climate change will be here to stay unless the world does something about it. Global warming is producing ever-extreme weather patterns that threaten the world economy, and with it the returns that investors can expect. If the Paris Agreement target of limiting global warming to 2 degrees cannot be met, this will have profound implications for returns.

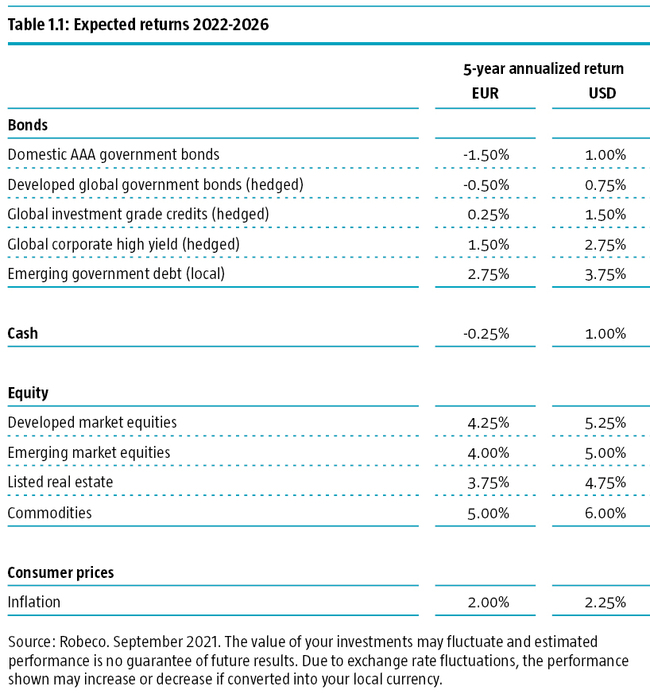

This is why the impact of climate change has been factored into the predictions for all the main asset classes for Expected Returns for the first time in its 11-year history. Entitled ‘The Roasting Twenties - Things are Heating Up' - the outlook forecasts what might happen to returns for equities in developed and emerging markets, government bonds, investment grade and high yield credits, commodities, real estate and cash.

This is done under various scenarios for economic recovery from Covid-19 using a bull, bear and stag case with a particular focus on the likely inflationary outcomes. Given the supply-side constraints and the likely boom in demand for raw materials, commodities are seen as the best-performing asset class over the 2022-2026 period. This is followed by developed market equities, which are set to benefit from higher corporate earnings as the global economy improves. Government bonds and cash are seen as negative yielding.

Bonds, equities and commodities

Climate change is particularly negative for government bonds due to projected declines in GDP per capita. Swiss Re forecasts an 18% drop in global GDP by 2050 if nothing is done to try to achieve net zero carbon by this date to meet the 2 degree Paris Agreement upper limit. Historically, real bond yields are around 80% of real GDP growth. Robeco's calculations suggest that investors should subsequently expect bond returns to be 0.4% lower in annualized terms between now and 2050.

The key question for equities is how climate change will affect the cashflow generation abilities of the average listed company. In the long run, one should expect earnings growth to equal long-run economic output growth. If GDP per capita growth is structurally impaired by climate change, as Swiss Re suggests, this would imply corporate earnings growth falls by around 0.5% per year between now and 2050. Earnings growth in emerging markets is expected to fall by more than this.

For commodities, climate change seems to be a double-edged sword. On the one hand, demand for commodities might fall as global economic activity is impaired. On the other, demand is soaring for certain commodities used in solutions such as the batteries needed for electric vehicles. In the scenario of the green energy transition, the commodity intensity of economic activity would increase - so on balance we expect commodity returns to be higher than average in the coming five years.

Three special topics

The outlook also contains three special themes of topical interest for investors. As the value investing style comes back into vogue, ‘Factor investing: why some factors are more equal than others' assesses which factors are set to do best. Bitcoin has been a rollercoaster for those brave enough to buy it, so ‘Cryptocurrencies: what's so cryptic about them?' discusses whether it should count as an asset class. Finally, ‘Central banks' post-pandemic playbook' analyses the options available as QE programs start to wind down.

This latter subject will in itself have repercussions for just how well the global economy does recover from Covid-19, working alongside the massive investment needed for the green transition to a carbon-neutral future, and the societal changes that the pandemic brought. The exact magnitude of climate change over the next decade remains uncertain, and its impact - and those of the policies and regulations to combat it - on asset prices is still unclear. As ever for investors, being forewarned is forearmed, which is where we hope Expected Returns can help.