Chris Parker, Head of UK Institutional Sales, Man Group

Today, defined contribution (DC) investors face a conundrum.

Many DC strategies are built on the classic ‘diversified' portfolio (that is, a balance of equities and bonds). For years, its proponents have argued that when one asset class in the mix is affected by poor performance, the other one will pick up the slack.

But Man Group's proprietary research, as of October 2023, shows that when core inflation is persistently above 2.7% p.a., the correlation between equities and bonds –– i.e. the similarity of both positive and negative performance –– has historically been positive on average. That means, in a shaky equity market during these periods, investors can't necessarily rely on bonds to provide portfolio stability. Just look at 2022, when equity and fixed income assets both suffered significant losses at the same time.

Currently, many pension schemes and asset allocators are turning to ‘alternative' (or ‘alt') approaches to provide a diversified return stream. This term captures a wide variety of asset classes, promising benefits such as an ‘illiquidity premium': a higher yield as compensation for the asset being harder to sell. But are all these approaches truly different – and importantly, truly diversifying? And what is more important: diversification by asset class, or by return drivers?

An array of alts

There is a bewildering array of alternative asset classes out there, so let's take a look at what's on offer:

By their nature, private equity and venture capital markets may offer an illiquidity premium to investors, although some newer structures (e.g. long-term asset funds, or LTAFs) now provide greater liquidity. However, high fees limit the ability to invest at scale for most pension schemes, especially given the government's charge cap. This limits the types of more expensive asset that schemes can invest in.

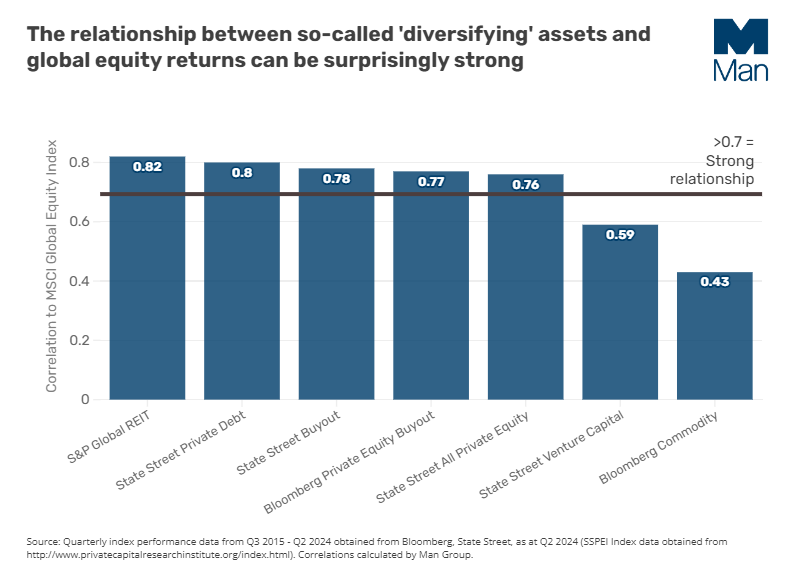

What is more, the promise of diversification can be illusory. A valuation lag (delay in asset pricing, as there is no exchange to offer daily liquidity) creates the illusion of lower volatility, but returns may actually be highly correlated with the main risk factor in a DC portfolio: public market equities. Even in certain LTAFs, where a portion of the assets are invested in liquid investments, a valuation lag may still affect other parts of the portfolio.

"The promise of diversification can be illusory"

Investors seeking a hedge against inflation may turn to commodities, using the logic that holding the assets whose prices are rising may offer protection from those price rises. Commodities may not be affected by the economic cycle in the same way as some of the equities and bonds in an investor's portfolio, yet each individual type of commodity will vary in its ability to offer diversification.

There is also the practical challenge of implementing this strategy. A single commodity approach requires a high level of governance and expertise. Returns can be volatile, even for diversified indices such as the Bloomberg Commodity Index Overview (BCOM) or the S&P GSCI.

What about REITS and property? Although these assets are typically illiquid, they tend to have a high correlation to both economic cycles and equities, limiting their diversifying benefits. Gating challenges during stressed periods are also a concern, as well as a sensitivity to interest rates akin to bonds.

Infrastructure – both equity and debt, is another asset class which is touted as a diversifier. But limited options for liquid implementations mean reduced compatibility for most DC schemes, particularly those investing via platforms where daily dealing or daily pricing is required. There is also the question of whether the relative return spread of infrastructure versus more liquid bonds justifies the investment.

Mixing it up

It's clear that, while private assets can provide an uncorrelated return stream to your main DC risk factors, it's far from guaranteed.

Instead, we think the definition of what constitutes alternatives should be broadened. Rather than focusing solely on the number of asset classes being access, investors need to consider diverse return streams in order to both generate long-term returns and offer protection when the rest of their portfolio is struggling. This applies particularly later in the savings journey, as members become more sensitive to portfolio drawdowns and start to de-risk.

A more liquid expression of a diversifying multi-asset portfolio may offer more robust portfolio construction benefits than simply relying on expanding the asset mix.

Using a flexible, market-neutral approach to all the major asset classes (meaning that the strategy can short sell as well as positively own an asset class) allows investors to target multiple sources of potential returns and increases the chance of accessing a truly uncorrelated source of return. We believe it can act as a complementary diversifier to traditional equities and broad fixed income market exposures. Just look at the chart above.

What's more, using liquid underlying instruments (i.e. equities and bonds), rather than more difficult-to-come-by and difficult-to-trade real estate and infrastructure assets helps to make the portfolio more cost-effective, more transparent, and importantly more liquid.

Finally, the resulting improved drawdown and volatility characteristics of a member's DC portfolio can help address sequencing risks (when the timing of investment withdrawals affects an investor's overall return). Therefore, these assets can potentially offer improved outcomes for members, particularly as schemes de-risk from equities.

Conclusion: Dare to be different

Retirement portfolios are no different to other investment portfolios – savers should be targeting as many different returns streams as possible.

There's a place in DC retirement portfolios for illiquid strategies and harvesting an illiquidity premium. However, we believe that relying on private markets, property, infrastructure and commodities alone for investors' alternative component will not sufficiently diversify their portfolios, as many of these assets can be more correlated with the broad equity market than they first appear. We feel that a truly alternative investment approach – one which seeks to offer a consistently diversifying return stream in a liquid format – will prove to be a very welcomed complement to traditional equity, fixed income and credit allocations.

To find out more about DC Pensions at Man Group or get in touch, please visit: Defined Contribution Capabilities | Man Group