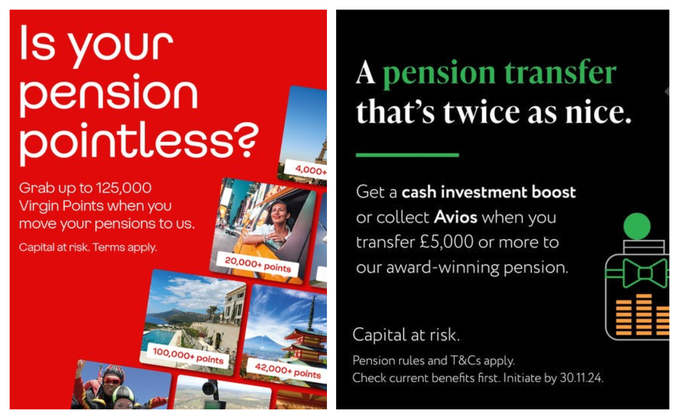

Some of the Facebook adverts I have recieved over the past week

‘Is your pension pointless?’ This was the question posed by Virgin Money UK in an advert that appeared on my Facebook timeline this weekend (see above left).

The advert text continued: "Does your pension provider treat you to travel, or extraordinary experiences? We do. Move your pensions to us, and we'll give you up to 125,000 Virgin Points to spend with Virgin Red (the rewards club from Virgin). That could take you further than you think with flights, adventures and more.

"And while you're living it up, here, there, and everywhere, you can relax knowing your pensions are all in one place."

It added: "To qualify, simply transfer one or more pensions worth at least £1,000 into a Virgin Money pension before 23 August 2024 and keep it there until 20 December 2024."

Eek… 23 August… Just a few days to make up my mind then otherwise I might miss out.

The offer in full can be viewed on Virgin Money's website.

But what would 125,000 points get me? For 95,000 points, I could have a four-night cruise in the Caribbean between June and September; for 26,500 points, I could be going off on a two-night classic British inn break for two; and for 20,000 points, I could enjoy a 12 bottle case of wine.

So powerful incentives. But what about the charges? These were less easy to find, but after a bit of digging around, I found the relevant page, which stated "charges for our pension total no more than 0.75% per year, of the value of your pension pot". This includes a 0.3% account charge and an annual management charge of up to 0.45%.

‘Twice as nice'?

Hold on a moment though… Another advert has also popped onto my timeline. This one is for Nutmeg (above right) and promises me a pension transfer that is "twice as nice" – offering me either a "cash investment boost" paid into my Nutmeg account (which I can then invest or withdraw) or Avios points "to go towards a future trip".I

If I transferred a pension worth £300,000 or more, I could get a £3,000 cash boost or 300,000 Avios points.

How much would this cost? For a pot worth £100,000 (an incentive of a cash boost of £1,000 or 100,000 Avios points), I would pay somewhere between 0.68% and 1.09% over the coming 12 months.

Source: www.nutmeg.com

The wrong incentives?

I'm not qualified to opine on whether a pension with Virgin Money UK, Nutmeg or any other personal pension provider is better value than the average workplace pension scheme.

I can however say with certainty that both of the above are more expensive than most occupational schemes and wonder whether, even with the latest work on value for money, the average member will be able to understand whether or not they are getting good value from such a transfer.

They will, however, be able to understand the value of 125,000 Virgin or 300,000 Avios points.

The size of pension transfer incentives is now astonishingly large. Let's hope the value of these don't lead people to make the wrong decisions about their retirement future.

Jonathan Stapleton is editor of Professional Pensions

Have your say: Join the conversation on this issue via my LinkedIn post on the topic.

Update (21 August): Since publishing the above article, PP has found a further two examples of significant transfer incentives being offered by providers. - Interactive Investor is offering cashback of between £100 and £2,000 and Fidelity is offering cashback of between £150 and £1500.